Antimony

Critical Minerals and The Energy Transition

Navigating the Antimony Market

Antimony is a strategically important metal with a wide range of industrial applications and rising significance in global supply chains. Classified as a critical mineral in many jurisdictions, antimony is valued for its unique chemical and physical properties, which make it indispensable to sectors such as fire safety, energy storage, electronics, and metallurgy. The global antimony market is shaped by both robust demand and increasingly complex supply dynamics. Its use in flame retardants, lead-acid batteries, and speciality alloys highlights antimony's central role in enabling safer, more resilient materials across diverse applications. Yet, this growing demand is met with an uneven and geographically concentrated supply base, dominated by China and a handful of secondary producers. Compounding these supply risks are environmental and regulatory pressures associated with antimony mining and refining. As a result, industries are seeking ways to bolster resilience through recycling, substitution, and new sourcing strategies. Navigating the antimony market today requires a nuanced understanding of geopolitical dependencies, technological shifts, and the emerging push toward more sustainable supply chains.

An introduction to antimony

Antimony demand and end-uses

Antimony is a critical component across modern manufacturing and technology sectors. Antimony is extensively used in the production of flame retardants, capitalising on its ability to enhance the fire-resistant properties of textiles and plastics. This application alone accounts for a significant portion of global antimony consumption, underlining the material's pivotal role in safety and compliance with fire safety regulations.

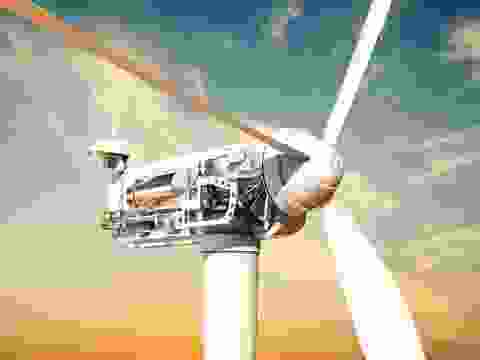

In electronics, antimony is a key component in the manufacture of semiconductors and lead-acid batteries. Its conductive properties improve battery performance and longevity, catering to the growing demand for reliable and efficient power sources in automotive and renewable energy storage systems.

Additionally, antimony is used in the creation of alloys, particularly for lead and tin, demonstrating its versatility in enhancing material strength and hardness. These alloys find extensive use in the automotive, defence, and manufacturing sectors, where durable and robust materials are crucial.

The glass and ceramics industry also benefits from antimony's unique properties, especially in the production of speciality glass, enamels, and glazes, where it acts as a clarifying agent and colour enhancer.

However, the diverse demand for antimony comes with its challenges and risks, including supply chain volatility and environmental concerns associated with mining and processing.

Antimony supply

Antimony supply is centralised, with China at the forefront as the leading producer and exporter, followed by nations like Tajikistan, Turkey, Russia, Myanmar (Burma), Bolivia, and Australia. Other countries such as Mexico, Laos, Pakistan, Kyrgyzstan, Kazakhstan, Iran, Vietnam, Guatemala, and Canada contribute smaller quantities. This concentration highlights the dual nature of antimony sourcing, involving direct mining and recovery as a by-product from smelting base metal ores, especially those rich in lead, copper, and to a lesser extent, silver and gold. Such dynamics introduce a complex layer to antimony's global supply chain, posing opportunities and challenges for industries dependent on this critical metal for various applications.

Antimony production primarily comes from lead ores, where it is found in significant quantities and recovered as a valuable by-product during the lead smelting process, particularly when economically viable. Additionally, antimony is produced from base metal ores, including those of copper, where it appears as a trace element. Though copper ores have lower antimony levels than lead ores, the extensive scale of copper mining makes it a notable antimony source. Silver and gold ores also contribute to antimony supply, with their complex mineral compositions allowing for antimony recovery during metal extraction and refining, contingent on ore characteristics and process efficiency.

The geopolitical landscape significantly impacts antimony supply, as regulatory changes, trade policies, and environmental considerations in key producing countries can alter output levels and market stability. Additionally, the finite nature of antimony reserves prompts concerns over long-term availability, driving research into recycling methods and the search for viable substitutes.

Due to the toxic by-products associated with antimony extraction and processing, mining and production activities are subject to stringent environmental regulations. These regulations, while necessary for environmental protection and worker safety, can limit supply growth by imposing additional costs and operational constraints on producers.

The demand for antimony in flame retardants, lead-acid batteries, and alloys underscores the strategic importance of securing stable supply chains. Manufacturers and industries dependent on antimony are increasingly exploring recycling as a supplementary source to mitigate supply risks and reduce environmental impact. Recycling antimony from end-of-life products and industrial waste supports circular economy initiatives and lessens the dependency on mined antimony.

Historical antimony producers

Antimony substitution

For flame retardants, the industry adopts organic compounds and hydrated aluminium oxide as flame retardants instead of antimony, balancing safety with environmental benefits. However, while these alternatives meet flame retardancy standards, their performance in specific applications and long-term durability may vary, posing a risk of inconsistency in some product formulations.

Replacing antimony in coatings and pigments with chromium, tin, titanium, zinc, and zirconium compounds can enhance product quality, including better colour and durability. However, the variability in chemical interactions could introduce risks in colour fidelity and consistency across different production batches.

For lead-acid batteries, substituting antimony with calcium, copper, selenium, sulfur, and tin offers comparable, if not superior, performance, potentially improving battery efficiency and lifespan. Nevertheless, these alternative mixtures may present challenges in material sourcing and could affect the overall cost-effectiveness and market competitiveness of the batteries.

Meet the Critical Minerals team

Trusted advice from a dedicated team of experts.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Jamie Underwood

Principal Consultant

Ismet Soyocak

ESG & Critical Minerals Lead

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.