China

Critical minerals, policy, and the energy transition

The Energy Transition in China

China is at the forefront of the global energy transition, and critical minerals play a pivotal role in shaping its future. As the world’s largest producer and consumer of critical minerals, China’s strategic control over key resources such as lithium, cobalt, rare earth elements, and graphite positions it as a dominant force in the green energy and technology sectors. These minerals are essential for renewable energy technologies, electric vehicles (EVs), and advanced electronics, vital to China’s ambitious decarbonisation goals. Geopolitically, China’s dominance in the critical minerals supply chain has led to growing international scrutiny and competition. With tensions rising over resource access, China’s Belt and Road Initiative (BRI) has expanded its influence in resource-rich regions such as Africa and Latin America, further consolidating its control over essential materials. This has sparked concerns among global powers, particularly the United States and the European Union, who are increasingly seeking to diversify their supply chains to reduce dependence on China. As the energy transition accelerates, the geopolitics surrounding critical minerals will play a crucial role in defining global power dynamics in the coming decades. The Chinese government has committed to achieving carbon neutrality by 2060, with a focus on expanding renewable energy capacity, enhancing energy storage solutions, and scaling up EV production. The country is also making significant strides in the development of green technologies, such as solar panels and wind turbines, which rely heavily on critical minerals. This has reinforced China’s position as both a major producer and consumer of the very resources needed to drive its clean energy revolution.

Latest news and insights

Stay ahead in the energy transition with SFA (Oxford)’s cutting-edge insights into how critical minerals, supply chain strategy, ESG mandates, and global trade policy are redefining China’s role in energy leadership.

China Imposes Export Controls on Rare Earths

5 April 2025 | Jamie Underwood

China imposes sweeping export controls on critical medium and heavy rare earths, escalating strategic competition over high-tech and defence supply chains.

Declaring a US Trade Emergency

3 April 2025 | Jamie Underwood

The US declared a trade emergency, imposing sweeping tariffs, rare exemptions, and bold legal moves. What triggered it, and what will happen next?

Annex-I: Adjusted US Reciprocal Tariffs Country List

2 April 2025 | White House

Iridium’s outlook linked to hydrogen economy wariness

21 October 2024 | SFA (Oxford) & Heraeus

Chinese heavy-duty vehicle platinum demand could be ready for a rise

7 October 2024 | SFA (Oxford) & Heraeus

Where does the palladium market go from here?

23 September 2024 | SFA (Oxford) & Heraeus

China's dominance in Critical Minerals and clean energy technologies

China has emerged as the dominant force in critical minerals supply chains while simultaneously pursuing an ambitious domestic energy transition. This dual position grants China unparalleled influence over the global green energy future, presenting both opportunities and challenges for international decarbonisation efforts.

China has strategically built a commanding position in the processing and manufacturing of critical minerals, creating dependencies that significantly impact global energy security dynamics.

Although China does not dominate the upstream extraction of most critical minerals, it has firmly established control over processing and refining operations. China produces nearly all of the battery-grade graphite, a significant proportion of lithium chemicals, a substantial share of refined copper, a large majority of refined magnet rare earths, and a dominant portion of refined cobalt. This dominance in processing creates a strategic chokepoint in global supply chains.

China’s control extends beyond mineral processing to the manufacturing of components essential for clean energy technologies. The country is responsible for the largest share of the global production of mineral-rich components for battery cells, including the majority of cathodes (the most expensive component), anodes, separators, and electrolytes. Even more significantly, China holds a dominant share of the world’s cell manufacturing capacity for EV batteries and hosts the majority of the world’s lithium-ion battery gigafactories.

To secure upstream resources that feed its processing operations, China has implemented a comprehensive global investment strategy. Between 2000 and 2021, Chinese financial institutions provided nearly $57 billion in loans to 19 low- and middle-income countries specifically targeting critical mineral resources. This investment approach involves a network of at least 26 state-backed financial institutions working to extend China’s control over minerals essential for the energy transition.

China has strengthened its supply chain by financing transition mineral extraction across the developing world focusing on copper, lithium, nickel, cobalt, and rare earth elements to control global mineral sources.

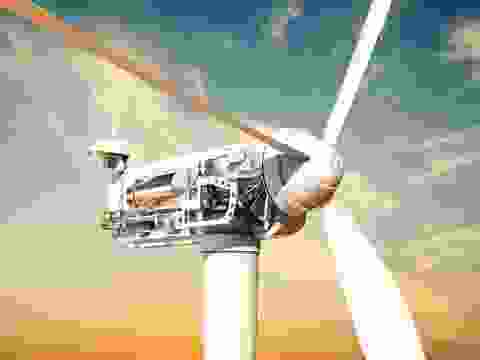

While China’s control varies across different minerals, its position in rare earth elements (REEs) is nearly one of complete vertical integration. China currently accounts for around 60% of mined magnet rare earths and >80% of refined magnet rare earths. These elements are especially vital for wind turbines and electric vehicle motors.

China’s rare earth dominance began decades ago when the government prioritised mining for these elements in the 1970s. Within six years, China had developed technology for refining high-purity materials, eventually becoming a global leader in mineral refining by the 1990s. This early strategic focus allowed China to become the predominant producer, at one point controlling 95% of global production, though this figure has decreased to around 60% by 2019.

In parallel with establishing dominance in critical minerals supply chains, China has embarked on an ambitious domestic energy transition, despite remaining the world’s largest carbon emitter.

In 2020, China announced its goal to reach peak carbon emissions by 2030 and achieve carbon neutrality by 2060. This commitment has driven significant investment in renewable energy deployment and clean technology manufacturing. China led global energy transition investment in 2024, accounting for two-thirds of the $2.1 trillion spent globally on initiatives ranging from power grids to electric transport.

The high concentration of processing operations in China presents a significant vulnerability for the global energy transition, particularly if investments in production capacity fail to meet demand or if geopolitical risks arise within or between producer nations. Both the European Union and the United States have recognised their dependence on China for critical inputs and technologies as a major reason to bolster their mineral supply chain resilience.

China’s leveraging of its dominance in critical mineral supply chains is partly a response to US measures aimed at curbing China’s access to advanced technologies. This has led to tit-for-tat trade restrictions between China and the US. Export restrictions have expanded over the past year, extending beyond the semiconductor industry to battery supply chains and national security-related minerals such as antimony.

The success of global climate efforts will depend significantly on how China manages its critical minerals dominance and how other nations respond to this reality. As competition for these resources intensifies, cooperation on sustainability standards and supply chain resilience may ultimately determine whether the world can achieve its climate goals without compromising economic security or environmental standards.

China's electric vehicles and renewable energy expansion

Electric vehicles (EVs) have become key to China’s energy transition strategy. This shift began formally in 2009 when the State Council outlined a national new energy vehicle (NEV) development strategy and launched the "Ten Cities, Thousand Vehicles" initiative. By 2014, President Xi Jinping declared that NEVs are "an essential path for China to transition from a major automobile producer to a strong automobile powerhouse."

With robust policy support and subsidies, China’s NEV production reached 78,499 units in 2014, marking a 3.5-fold increase from the previous year. This growth has continued, positioning China as the world’s largest EV market and manufacturer.

China’s renewable energy capacity is growing at an extraordinary pace. Currently, China produces approximately 30-31% of its electricity from renewable sources, including wind, solar, hydroelectricity, and geothermal. Projections indicate that by 2026, solar will overtake coal as China’s leading energy source, and by 2050, renewables will constitute 88% of China’s power mix, with solar alone contributing 38%.

Between 2019 and 2024, China is expected to account for 40% of global renewable capacity expansion, driven by improved system integration, lower curtailment rates, and enhanced competitiveness of both solar photovoltaic (PV) and onshore wind. China is also set to lead global growth in biofuel production.

China’s strategic positioning in critical minerals and its domestic energy transition represent one of the most significant developments in global energy geopolitics. Through decades of foresight and investment, China has gained control over key supply chains essential for decarbonisation while simultaneously working to transform its own energy system.

China's energy and power mix

Critical Minerals produced in China

Energy Raw Materials and products produced in China

Essential minerals production and products in China

Critical Minerals mapping and policy developments

Meet the Critical Minerals team

Trusted advice from a dedicated team of experts.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Jamie Underwood

Principal Consultant

Ismet Soyocak

ESG & Critical Minerals Lead

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.